- Referenzen

- Unternehmen

- MagazinMagazin | Die bunten Seiten der iS2 AG

Kompetent. Verlässlich. Flexibel.

Wir machen Sie fit für das digitale Zeitalter

Software und Beratung für Versicherungsunternehmen

Wir helfen Versicherungen bei der Optimierung und Digitalisierung Ihrer Prozesse.

Mit modernen und intelligenten Lösungen, die nicht nur Sie, sondern auch Ihre Kunden begeistern werden.

Lösungen

Wir entwickeln individuelle und ganzheitliche Lösungen für Versicherungen, mit denen wir Sie im Beratungsalltag und bei der digitalen Transformation Ihres Unternehmens unterstützen.

Module

iS2 Software ist innovativ, flexibel und optimiert für Ihren Vertriebserfolg. Dank ihres modularen Aufbaus können unsere Lösungen an Ihre individuellen Bedürfnisse angepasst werden.

Services

Für Versicherungsbetriebe sind wir DER verlässliche Partner auf dem Weg in die digitale Zukunft. Mit umfassender Beratungskompetenz und Branchen-Know-how seit über 30 Jahren.

Auf der Suche nach erfahrenen Experten für Ihre IT-Projekte?

Wir unterstützen Sie im Bereich Personalbedarf mit zuverlässigen und kompetenten IT-Fach- und Führungskräften.

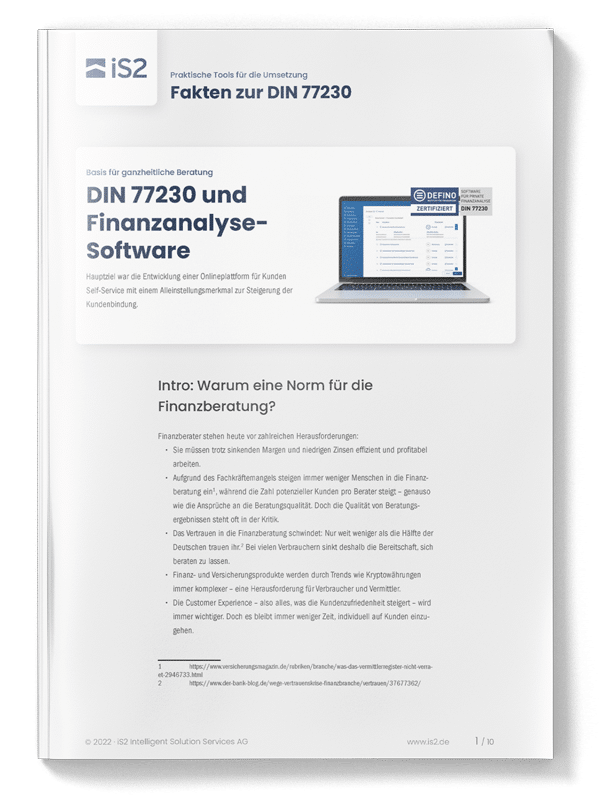

Entdecken Sie mit unseren umfangreichen Whitepapers die Schlüssel zur digitalen Revolution in der Versicherungsbranche

Vom Interessenten zum loyalen Kunden

Die Kunst der Lead-Generierung in der Versicherungsbranche

Bereit für die digitale Transformation Ihres Business?

Immer gut informiert

Entdecken Sie aktuelle Pressemeldungen und Beiträge aus unserem iS2 Magazin

Newsletter abonnieren

Mit unserem iS2 Newsletter bleiben Sie immer auf dem Laufenden. Jetzt kostenlos anmelden!